Dealer Management System – Finance Management

Financial inefficiencies can slow down a dealership’s growth, leading to compliance risks and revenue loss. That’s why Excellon Software’s Dealer Management System (DMS) includes a Finance Management Module, built to automate processes, enhance financial accuracy, and drive business success. With this intelligent solution, dealerships can gain complete financial control, reduce manual efforts, and focus on scaling their operations.

Finance Management

A Finance Management Module in a Dealer Management System (DMS) is a component designed to streamline and automate financial processes within a dealership or automotive business. This module plays a crucial role in managing the financial aspects of the dealership’s operations.

The Finance Module ensures the smooth operation of financial transactions within a dealership, enhancing customer service and maintaining compliance with financial regulations in the automotive industry. It contributes to the overall efficiency and profitability of the dealership by optimizing financial processes and providing valuable insights into financial performance.

Here are some standard features of Finance Management System:

Features in Detail

- Receipts and Payments: An acknowledgment is a formal document confirming the receipt of money in exchange for goods or services. It serves as a record of the financial transaction, outlining agreed-upon terms. This document ensures transparency and accountability in exchanges involving goods, services, or both.

- Banking Management: This functionality encompasses several essential financial documents. The Bank Statement Document details transactions and cheque information. The Transfer Document serves as a business tool for transferring funds, whether through Bank Transfer or Cash Transfer. Additionally, there’s a document dedicated to recording Cash Deposits across various bank accounts. The Withdrawal Document is instrumental in tracking withdrawals, offering insights into available balances and details of issued cheques. Lastly, the Deposit Document serves as a financial record, documenting deposits made in specific business units and bank accounts, with the associated cash account specified for clarity in the deposit process.

- Auditing: Get detailed ledger information by drawing on various accounts. It also offers a comprehensive view of journal details categorized by different document types. Users can utilize this tool to gain insights into their financial records, efficiently tracking transactions and journal entries for enhanced financial management.

- Budget: It’s a tool for defining budgets within a financial period across various accounts. Users can leverage this functionality to establish and manage budgetary allocations, providing a structured approach to financial planning. It enables efficient control and monitoring of expenses, ensuring that financial goals align with predefined budgets for optimal financial management.

- Sales/Purchase Journals: A journal serves as the primary accounting record where all original financial transactions of a business are initially documented in chronological order. This chronological recording ensures a systematic and organized approach to tracking business transactions. In specific, the Sale Journal is a dedicated book for recording all sale transactions, while the Purchase Journal is utilized for documenting all purchase transactions. These specialized journals streamline the accounting process, providing a structured and efficient way to manage sales and purchases within a business.

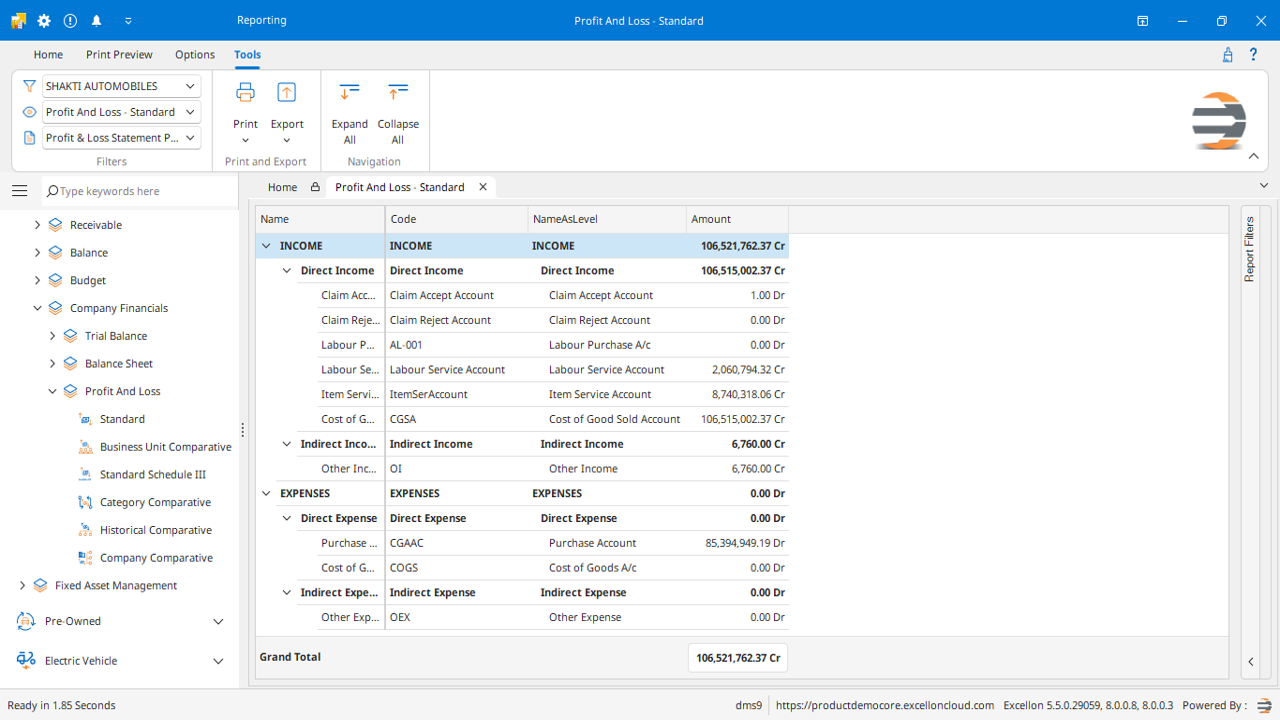

- Company Financials: The reporting system offers a suite of comprehensive financial reports to facilitate in-depth analysis. For the balance sheet, users can access standard format reports, breakdowns by business units, and insightful analyses comparing the current financial year to previous years, both within the business units and across various companies. Similarly, the Profit and Loss Statement reports come in standard formats, business unit-specific breakdowns, and category-wise comparative reports. These detailed reports enable a thorough understanding of the financial performance, supporting strategic decision-making and evaluation across different organizational dimensions.